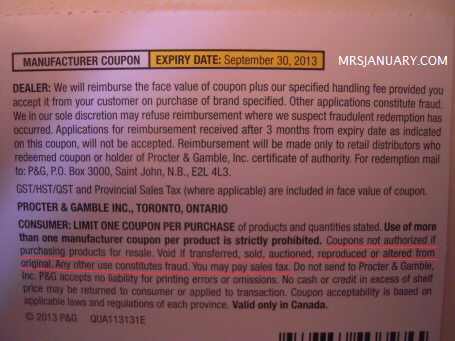

41 the tax book coupon

- Deals & Discounts for Hotel Reservations from ... Hotels.com | Find cheap hotels and discounts when you book on Hotels.com. Compare hotel deals, offers and read unbiased reviews on hotels. Tax Collector - Welcome Jul 11, 2022 · Duval County Tax Collector 231 E. Forsyth Street Jacksonville, FL 32202 (904) 255-5700 Email: taxcollector@coj.net Hours of Operation Monday - Friday 8:30 a.m. to 4:30 p.m. ... The Special Lien Improvement Book can be found here. This includes the DVI Assessment and 581 Hospital Liens. Updates to the Special Lien Improvement Book will be done ...

PAY YOUR PROPERTY TAXES – Treasurer and Tax Collector A 10-digit number (a.k.a., map book, page, and parcel) that identifies each piece of real property for property tax purposes, e.g., 1234-567-890. California Relay Service A telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

The tax book coupon

› sites › laurabegleybloom17 Ways You Can Make Money Online Right Now - Forbes Mar 25, 2020 · Best Tax Software For The Self-Employed Of 2022. Income Tax Calculator: Estimate Your Taxes. ... 13. Tap Into the E-Book Business. The e-book business is a great way to earn money. Connecticut Tax Forms and Instructions for 2021 (CT-1040) - Income Tax … Apr 18, 2022 · Open the PDF file and print the tax payment coupon and worksheet pages that you need for you records. Then, fill in and mail the payment coupon to the State of Connecticut Department of Revenue Services. Connecticut estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates. For the 2022 tax year ... 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation Nov 10, 2021 · The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the …

The tax book coupon. › legal-info › researchResearch | Lawyers.com research lawyer, attorneys, law and legal research information. Find research resources and locate an attorney specializing in research. Tax Maps and Valuation Listings | Maine Revenue Services Unorganized Territory, Property Tax Division, PO Box 9106, Augusta, Maine 04332-9106; Cost: Tax Map with ownership listing - $5.00 each; Valuation Book Listing (owner name, address, map and lot numbers, valuations) - $3.00 base charge + 20¢/page; Township Codes 2022-2023 Tax Brackets & Rates For Each Income Level - Debt.org Jan 09, 2018 · 2022 Tax Brackets (Due April 15, 2023) Tax rate Single filers Married filing jointly* Married filing separately Head of household; 10%: $0 – $10,275 veux-veux-pas.fr › en › classified-adsAll classifieds - Veux-Veux-Pas, free classified ads Website W.E. rental price €70 per night. GPS coordinates of the accommodation Latitude 43°8'25"N BANDOL, T2 of 36 m2 for 3 people max, in a villa with garden and swimming pool to be shared with the owners, 5 mins from the coastal path.

› en-ca › shopElectronics & Accessories | Dell Canada *Coupon Offer: Limited Quantities. Single use Coupon. Coupon cannot be combined with other discounts. Only one coupon may be applied per cart at checkout. Offer applies only to products and brands indicated and does not apply to systems or items purchased through the online systems configuration, refurbished items or spare parts. Tax Collected at Source ( TCS ) – Payment, Exemption & Rates of TCS Tax Sep 18, 2020 · As per the new TCS tax provision, if any seller has an annual turnover more than Rs. 10 crores in the preceding Financial Year then he from 1st October 2020 he is liable to collect TCS tax at a rate of 0.1% (0.075% till 31.03.2021) from the buyer if the buyer purchases products exceeding Rs. 50 Lac. Alcohol Tax - North Dakota Office of State Tax Commissioner The Office of State Tax Commissioner regulates the following types of alcohol manufacturers in North Dakota. Brewer Taproom – This is a beer manufacturer who can sell their product onsite with a tasting room and self-distribute their product directly to retailers and through wholesalers. They can only sell their product. › taxes › how-to-calculateHow to Calculate Your Tax Withholding | RamseySolutions.com Apr 13, 2022 · If you’re married and filing jointly, for example, and your taxable income is around $107,000 for the 2021 tax year, that puts you in the 22% tax bracket. But you actually won’t pay 22% on your entire income because the United States has a progressive tax system.

› tax › brackets2022-2023 Tax Brackets & Rates For Each Income Level - Debt.org Jan 09, 2018 · 2022 Tax Brackets (Due April 15, 2023) Tax rate Single filers Married filing jointly* Married filing separately Head of household; 10%: $0 – $10,275 Tax Forms | State Accounting Office of Georgia All new employees should complete and sign the Federal W-4 and State G-4 tax forms. The forms will be effective with the first paycheck. If you do not provide Human Resources with the completed W-4 and G-4 forms, taxes will be withheld at the maximum tax rate. Federal W-4 form. Georgia G-4 form 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation Nov 10, 2021 · The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the … Connecticut Tax Forms and Instructions for 2021 (CT-1040) - Income Tax … Apr 18, 2022 · Open the PDF file and print the tax payment coupon and worksheet pages that you need for you records. Then, fill in and mail the payment coupon to the State of Connecticut Department of Revenue Services. Connecticut estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates. For the 2022 tax year ...

› sites › laurabegleybloom17 Ways You Can Make Money Online Right Now - Forbes Mar 25, 2020 · Best Tax Software For The Self-Employed Of 2022. Income Tax Calculator: Estimate Your Taxes. ... 13. Tap Into the E-Book Business. The e-book business is a great way to earn money.

Post a Comment for "41 the tax book coupon"