43 yield to maturity of coupon bond

Bond maturity value calculator - cukn.frauen-ferienhaus.de FV = $100,000 (par value ) N = 1 (number of remaining periods) PMT = $9,000 (9% coupon rate X $100,000 par value ) INT = 10% (Investors' required yield to maturity .) Solving for present value , we. wpf sta thread error; 1980 mongoose bmx for sale; the unwilling a ... Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

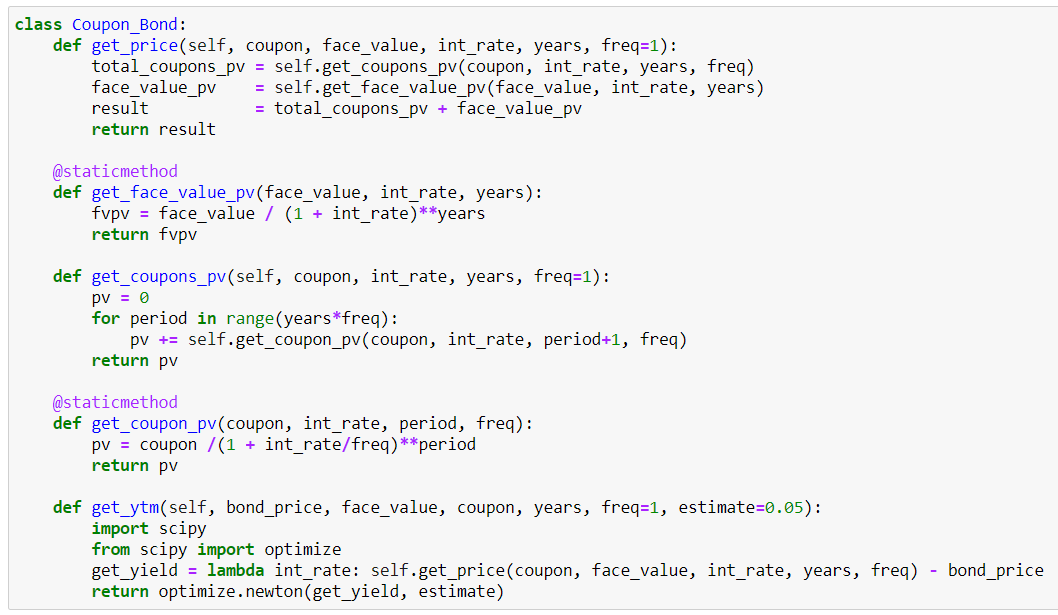

Excel yield to maturity Let us find the yield-to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9. In this article, we're going to talk about how to calculate the yield of maturity for a coupon bond. For a coupon bond, we're talking about a bond that's going to ...

Yield to maturity of coupon bond

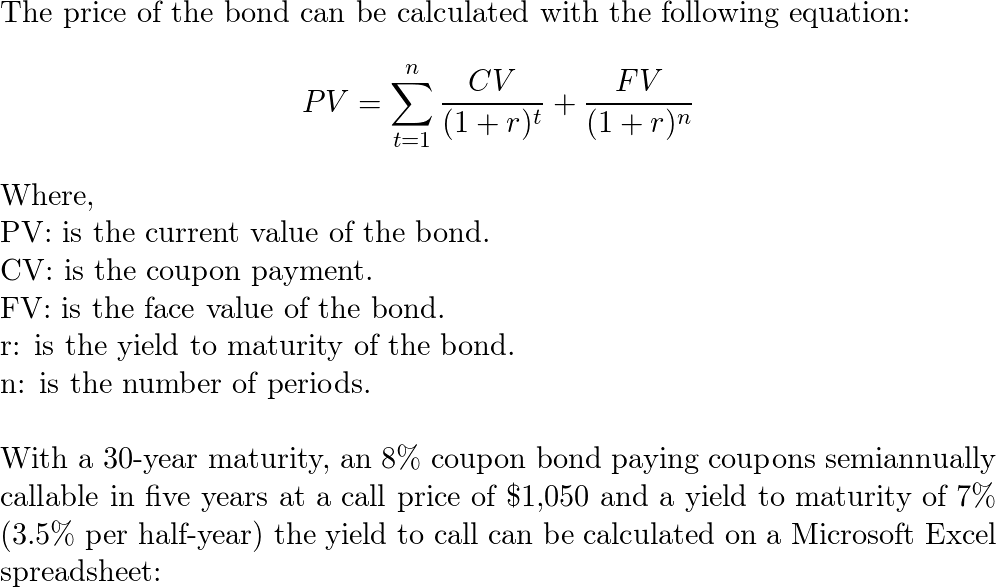

PDF Yield-to-Maturity and the Reinvestment of Coupon Payments before the horizon are invested at the yield to maturity to the horizon" and later on "In calculating the yield to maturity, the implicit assumption is that cash flows are reinvested at 6% for bond A and 6.1% for bond B (the respective yield to maturities)."(Elton, et. al. 2007, p. 507-508). A Bond's Maturity, Coupon, and Yield Level | CFA Level 1 - AnalystPrep Longer maturity bond prices are more sensitive to changes in yields than shorter maturity bonds. As shown in the following graph, the price of the 30-year bond increases a lot more than that of the 1-year bond in response to a decrease in interest rates. ... Smaller coupon bonds are more sensitive to interest rate swings than bonds which pay ... Yield to Maturity (YTM) - Wall Street Prep From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. In This Article What are the steps to calculating the yield to maturity (YTM) in Excel?

Yield to maturity of coupon bond. Yield to Maturity (YTM) Approximation Formula - Finance Train P = Bond Price. C = the semi-annual coupon interest. N = number of semi-annual periods left to maturity. Let's take an example to understand how to use the formula. Let us find the yield-to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9 ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity is an essential investing concept used to compare bonds of different coupons and times until maturity. Without accounting for any interest payments, zero-coupon bonds always... Bond maturity value calculator - pkchm.123poulets.fr The annual coupon interest rate is 14 percent and the market's required yield to maturity on a comparable-risk bond is 9 percent. The value of the bond is $___. ... Override Coupon End Of Month Rule:. A zero-coupon bond pays no coupons but will guarantee the principal at maturity. Purchasers of zero-coupon bonds earn interest by the bond being ... Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Realized Compound Yield versus Yield to Maturity - Rate Return We have noted that yield to maturity will equal the rate of return realized over the life of the bond if all coupons are reinvested at an interest rate equal to the bond's yield to maturity. Consider, for example, a two-year bond selling at par value paying a 10% coupon once a year. The yield to maturity is 10%. › terms › yYield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Therefore, for the many times the market value doesn't equal the par ... Therefore, for the many times the market value doesn't equal the par value, the yield to maturity is the same as calculating the IRR(Internal Rate of Return) on any investment. It is a calculation measuring the cash flows starting with the purchase of the bond, the coupon payments while holding the bond, and ending with the bond issuer. The current yield is .0619 or 6.19%, here's how to ...

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Yield to Maturity (YTM) - Definition, Formula, Calculations We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands trading in the US market. Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can ...

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

Yield to Maturity (YTM) Definition & Example | InvestingAnswers Yield to maturity refers to the return (or yield) that an investor will earn from their investment, which is typically reported as an annual rate. The return is comprised of interest payments (referred to as coupons) and any gain in the bond's market value. The yield is based on the coupon rate the bondissuer agrees to pay.

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

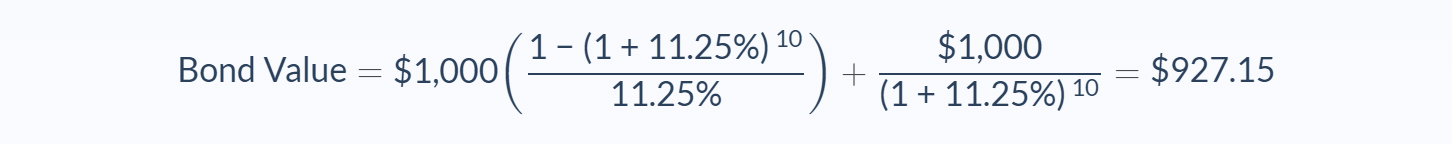

Yield to Maturity - Approximate Formula (with Calculator) The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be After solving this equation, the estimated yield to maturity is 11.25%.

Bond Yield Calculator - Yield to Maturity Calculator Bond Yield Calculator - calculate current bond yield and yield to maturity based on current bond price, par value, coupon rate and years to maturity.

Excel yield to maturity The required yield to maturity is close to 6%. At 5.865% the price of the bond is INR 950.02. Hence, the estimated yield to maturity for this bond is 5.865%. Variations of Yield to Maturity (YTM) Yield to Call. This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example ...

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ PK. On this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond. This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time.

goodcalculators.com › bond-yield-to-maturityYield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

Yield to maturity calculator - xie.graoskiny.pl Let us find the yield - to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9. ... May 12, 2022 · Example of Yield to Maturity Calculator Usage A bond is available for investment in the market which carries a Face value of Rs.1000 but has a ...

write down the formula that is used to calculate the yield to maturity on a twenty year 12 coupon bo

What is the Yield-to-maturity of a perpetual bond with a semi annual ... Answer (1 of 2): Since a perpetual bond does not have a maturity, the term yield-to-maturity is kind of a misnomer, but the yield for a perpetual is the amount of the payment per year, divided by the amount of money you pay for the instrument. That assumes that all the periods are the same exact...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

How to Calculate the Price of Coupon Bond? - WallStreetMojo The company plans to issue 5,000 such bonds, and each bond has a par value of $1,000 with a coupon rate of 7%, and it is to mature in 15 years. The effective yield to maturity is 9%. Determine the price of each bond and the money to be raised by XYZ Ltd through this bond issue. Below is given data for the calculation of the coupon bond of XYZ Ltd.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Learn the variations of yield to maturity. Bond issuers may not choose to allow a bond to grow until maturity. These actions decrease the yield on a bond. They may call a bond, which means redeeming it before it matures. Or, they may put it, which means that the issuer repurchases the bond before its maturity date.

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion.

Yield to Maturity (YTM) - Wall Street Prep From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the same interest rate. In This Article What are the steps to calculating the yield to maturity (YTM) in Excel?

Bond's Maturity, Coupon, and Yield Level | CFA Level 1 - AnalystPrep Longer maturity bond prices are more sensitive to changes in yields than shorter maturity bonds. As shown in the following graph, the price of the 30-year bond increases a lot more than that of the 1-year bond in response to a decrease in interest rates. ... Smaller coupon bonds are more sensitive to interest rate swings than bonds which pay ...

PDF Yield-to-Maturity and the Reinvestment of Coupon Payments before the horizon are invested at the yield to maturity to the horizon" and later on "In calculating the yield to maturity, the implicit assumption is that cash flows are reinvested at 6% for bond A and 6.1% for bond B (the respective yield to maturities)."(Elton, et. al. 2007, p. 507-508). A

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula.jpg)

![Yield to Maturity (YTM): Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2021/11/08150550/Yield-to-Maturity-Formula.jpg)

![Yield to Maturity (YTM): Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/19095826/Yield-to-Maturity-YTM-Formula-960x400.jpg)

Post a Comment for "43 yield to maturity of coupon bond"