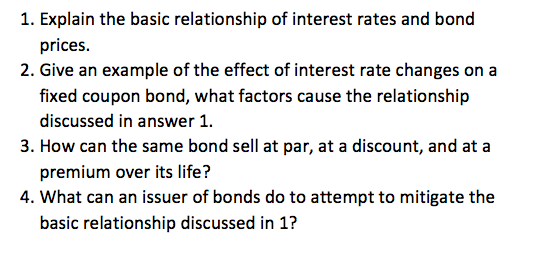

44 coupon vs interest rate

Coupon Rate Definition - Investopedia WebMay 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Military Daily News, Military Headlines | Military.com WebDaily U.S. military news updates including military gear and equipment, breaking news, international news and more.

Mortgage Rates: Compare Today's Rates | Bankrate WebSep 20, 2022 · Today's national mortgage rate trends. On Tuesday, September 20, 2022, the current average rate for the benchmark 30-year fixed mortgage is 6.33%, rising 23 basis points compared to this time last ...

Coupon vs interest rate

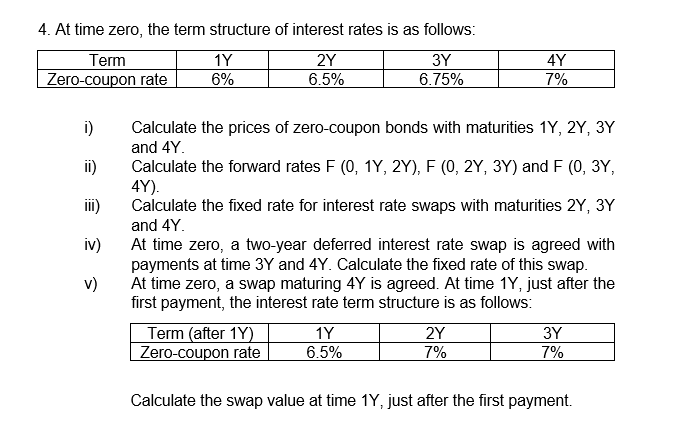

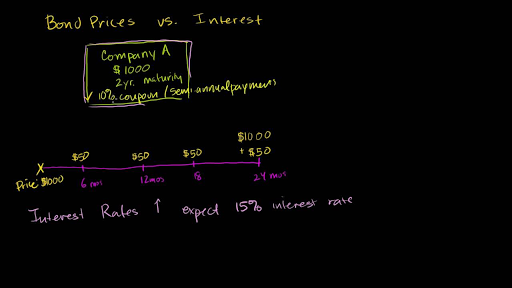

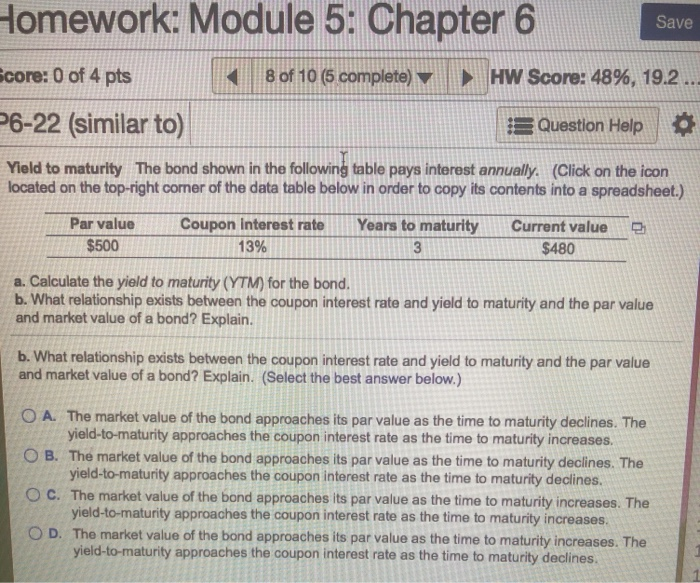

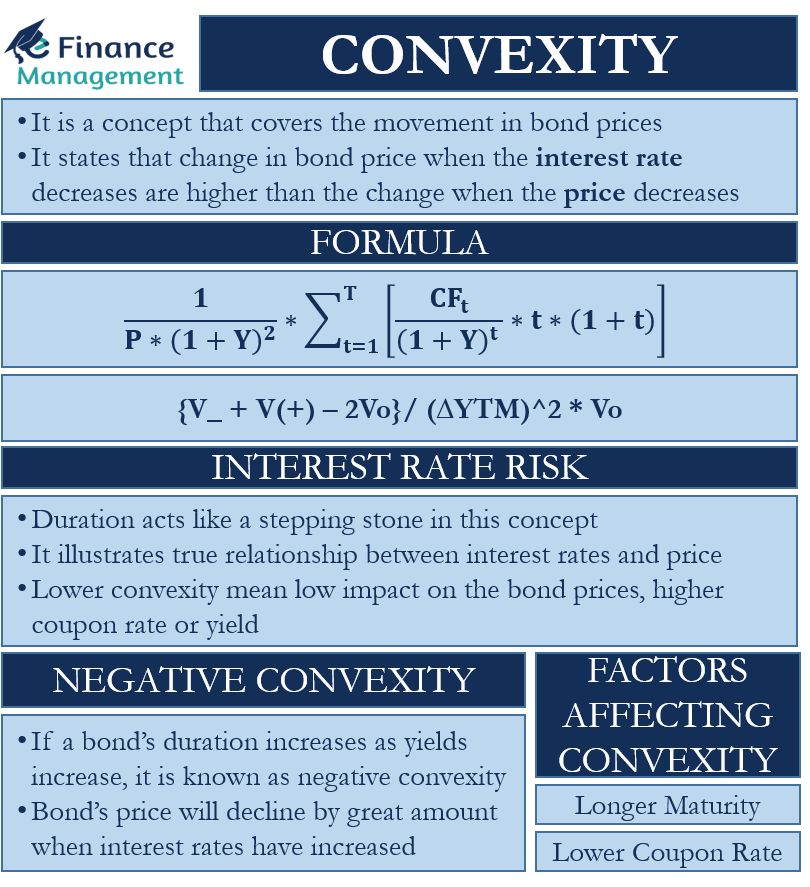

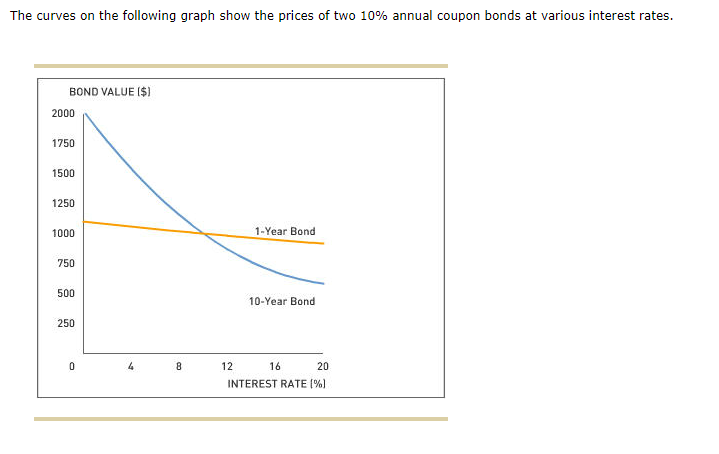

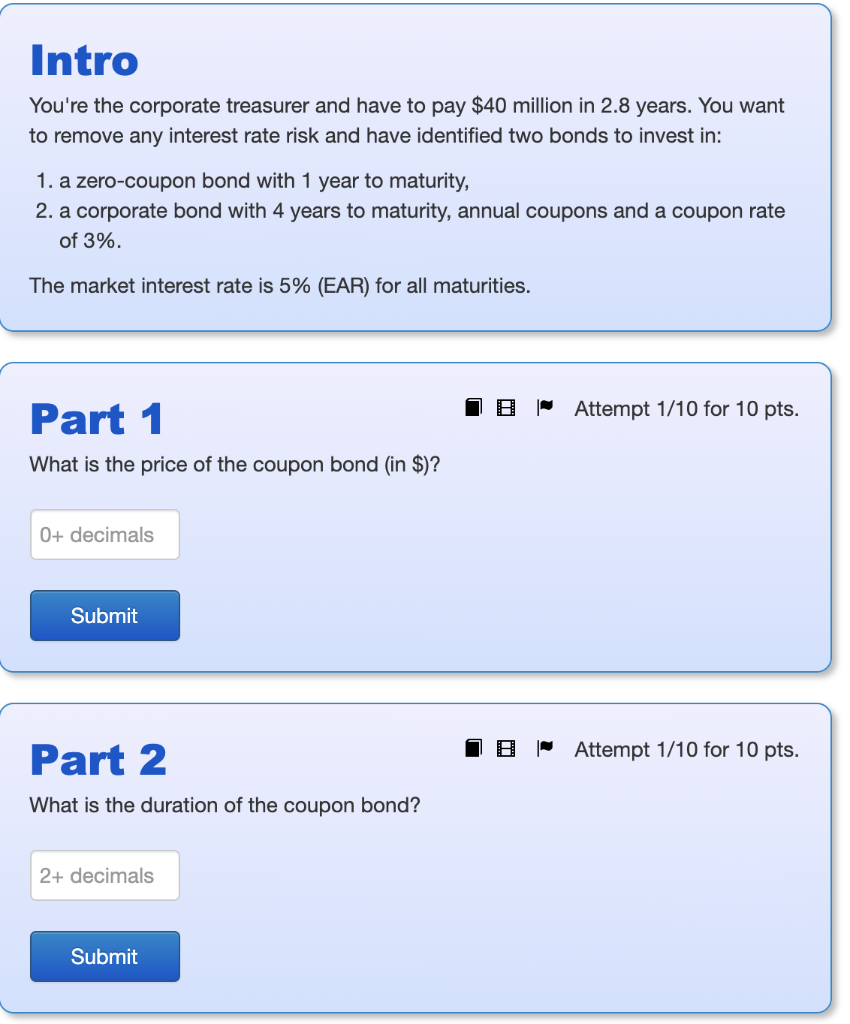

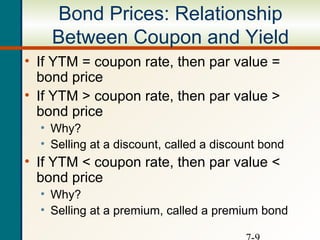

Coupon vs Yield | Top 5 Differences (with Infographics) WebThe yield of a bond changes with a change in the interest rate in the economy, but the coupon rate does not have the effect of the interest rate. Recommended Articles. This has been a guide to the Coupon vs. Yield. Here we discuss the top differences between coupon rate and yield to maturity along with infographics and a comparison table. Bond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo WebAlso, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

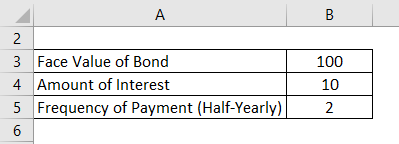

Coupon vs interest rate. Internal Rate of Return (IRR) Rule: Definition and Example - Investopedia WebAug 24, 2022 · Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount ... Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · Coupon Interest Rate vs. Yield . Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon ... What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia WebMay 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

CBS Pittsburgh - Breaking Local News, Weather & KDKA … WebCBS News Live CBS News Pittsburgh: Local News, Weather & More Mar 5, 2020; CBS News Pittsburgh Interest Rate Statistics | U.S. Department of the Treasury WebTo estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Variable Interest Rate: Definition, Pros & Cons, Vs. Fixed - Investopedia WebMar 31, 2021 · Variable Interest Rate: A variable interest rate is an interest rate on a loan or security that fluctuates over time, because it is based on an underlying benchmark interest rate or index that ... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo WebAlso, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Coupon vs Yield | Top 5 Differences (with Infographics) WebThe yield of a bond changes with a change in the interest rate in the economy, but the coupon rate does not have the effect of the interest rate. Recommended Articles. This has been a guide to the Coupon vs. Yield. Here we discuss the top differences between coupon rate and yield to maturity along with infographics and a comparison table.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)

Post a Comment for "44 coupon vs interest rate"